Fewer hurdles. Lower costs. Exceptional care.

Insurance and Healthcare Policy: Why I Do Things Differently

Healthcare in the United States is complicated, but the reality is simple: insurance companies often stand in the way of good medical care. Rising deductibles, shrinking reimbursements, and endless administrative hurdles have created a system where patients wait longer, doctors burn out, and the focus shifts from care to paperwork.

At my practice, we’ve chosen a different path. By staying out-of-network (with the exception of Medicare), we remove unnecessary obstacles between you and the treatment you need. This means:

Insurance company cannot practice medicine without a license and deny you care. Insurance denials are unethical as they involve medical decision making without examining you and often the person denying your care has NEVER trained in the specialty care you are seeking; With us, your care plan is based on medical need, not an untrained “peer”, algorithm, or insurance hurdle.

Transparent costs. Our service fees are clear and upfront, so you aren’t blindsided by surprise bills.

Better use of benefits. For many procedures, insurance companies require prior authorization before they’ll approve surgery, which can mean delays and extra visits. In my practice, you can move forward with care right away. If you have out-of-network benefits, we’ll give you the paperwork you need to submit, so your payment can still count toward your deductible and may even be reimbursed directly to you by your insurer

Focus on you. Without hours of paperwork, preauthorization, peer to peer reviews, denials, and appeals, we can spend more time on what actually matters—you.

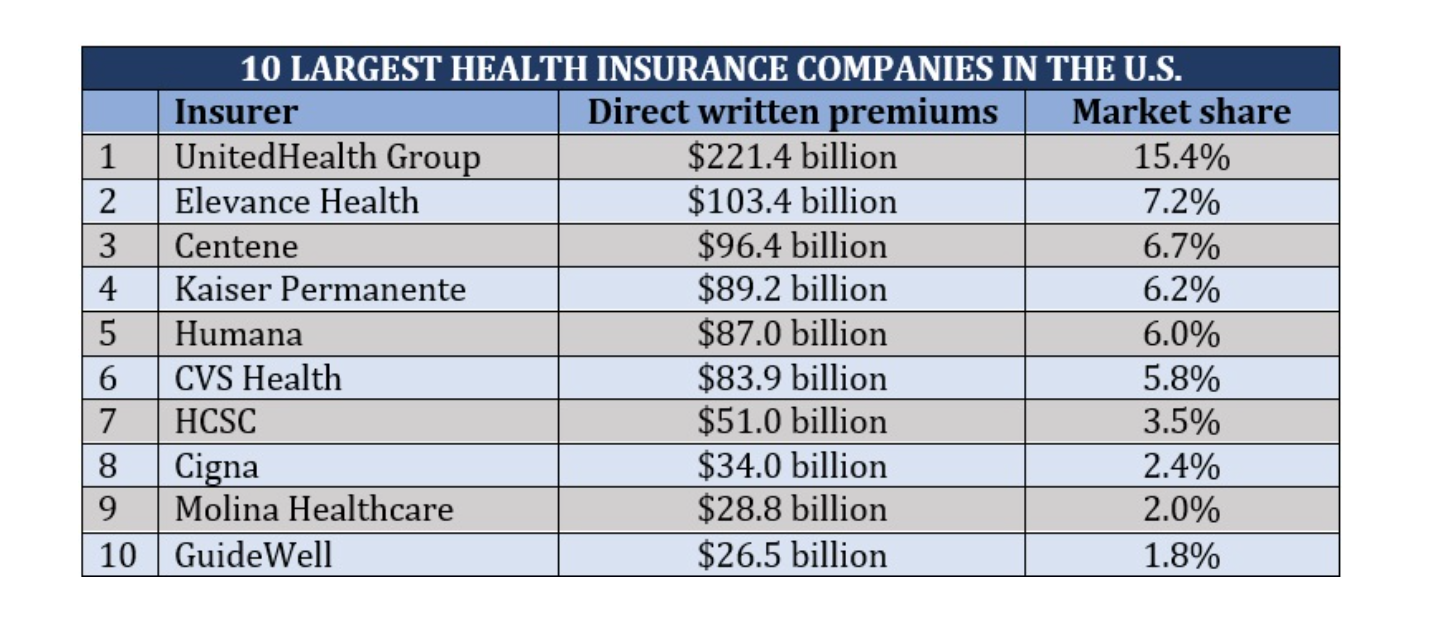

We believe healthcare should be straightforward: a patient and a physician working together toward the best outcome. Insurance companies—their CEOs and shareholders— prioritize profits over patients. Removing the for-profit insurance company lets me offer high-quality, affordable care without middlemen, keeping the doctor and patient at the center of every decision.

Real World Examples

Pre-Authorizations: A Waste of Time and Money

Me (after exam):

"I’m prescribing this medication for your condition."

Patient (at pharmacy):

"Insurance says we need prior authorization to confirm Dr. Shah wants this medication."

Reality:

I confirm: “Yes, I want to prescribe THIS medication.”

Prescription is rejected.

Insurance demands more of my time to discuss this medical decision with a non-peer reviewer—someone outside my specialty who has never examined the patient—to justify what I clinically decided.

Despite this, insurance denies the medication, effectively practicing medicine without a license or patient evaluation.

I must write multiple appeal letters. Months later they finally say ok after they realize I wasn’t going to forget.

In meantime, patient is frustrated, confused, and stuck without proper care.

Insurance CEOs & shareholders profit by denying YOU care.

This process wastes time and resources and creates unnecessary barriers to patient care, delaying treatment prescribed by highly trained specialists.

How Billing Works

Imagine going to a restaurant open to everyone, but diners must hire an outside company by paying a monthly premium membership fee to gain access. The membership promises that you can eat whenever you need, with your out-of-pocket expense capped at $1,000, after which they cover a percentage of your meal.

You order a $100 steak, expecting to pay $100. But then the membership company gets involved. Instead of a simple transaction, the company agrees to reimburse the restaurant only 20% of the bill they submit. The restaurant, needing to cover its costs, must submit a $500 charge to the company to receive the $100 it needs.

The restaurant’s bill looks outrageous. The diner ends up responsible for the full $500 out-of-pocket cost because the membership only kicks in after $1,000 in expenses for the year. Since the diner hadn’t yet reached that limit, they must pay the entire $500.

Here’s the breakdown: the diner pays $500 out-of-pocket, the insurance company pays the chef what they decide is fair. The restaurant gets $25 and the insurance company keeps the $475 difference. And this is on top of the premium the diner already paid just to have access. They do this over and over again, until their CEO earn about $30.0M; Then the insurance company tells the patient, sorry for the bill, the restaurant was just GREEDY.

This metaphor illustrates how confusing, disappointing, and frustrating billing practices are for both doctors AND patients. We understand these complexities and strive to make your experience as clear and straightforward as possible—minimizing confusion and eliminating surprise billing—so you can focus on your care.

FOR PROFIT INSURANCE COMPANIES DIRECT HEALTHCARE DOLLARS INTO MONEY BAGS FOR THEIR CEOS AND STOCKHOLDERS; THEY BLAME PHYSICIANS FOR DRIVING UP THE COST OF HEALTHCARE WHEN PHYSICIANS REPRESENT 8% OF HEALTHCARE COSTS. SO OUT OF THE $25 THE RESTAURANT GOT PAID, THE CHEF WAS PAID $2